Is Your Portfolio

Built for What's Next?

Built for What's Next?

Get your free portfolio score in 60 seconds. See how you compare to cycle-optimized strategies — then talk to a fiduciary advisor about what to do next.

As Featured In

Insights

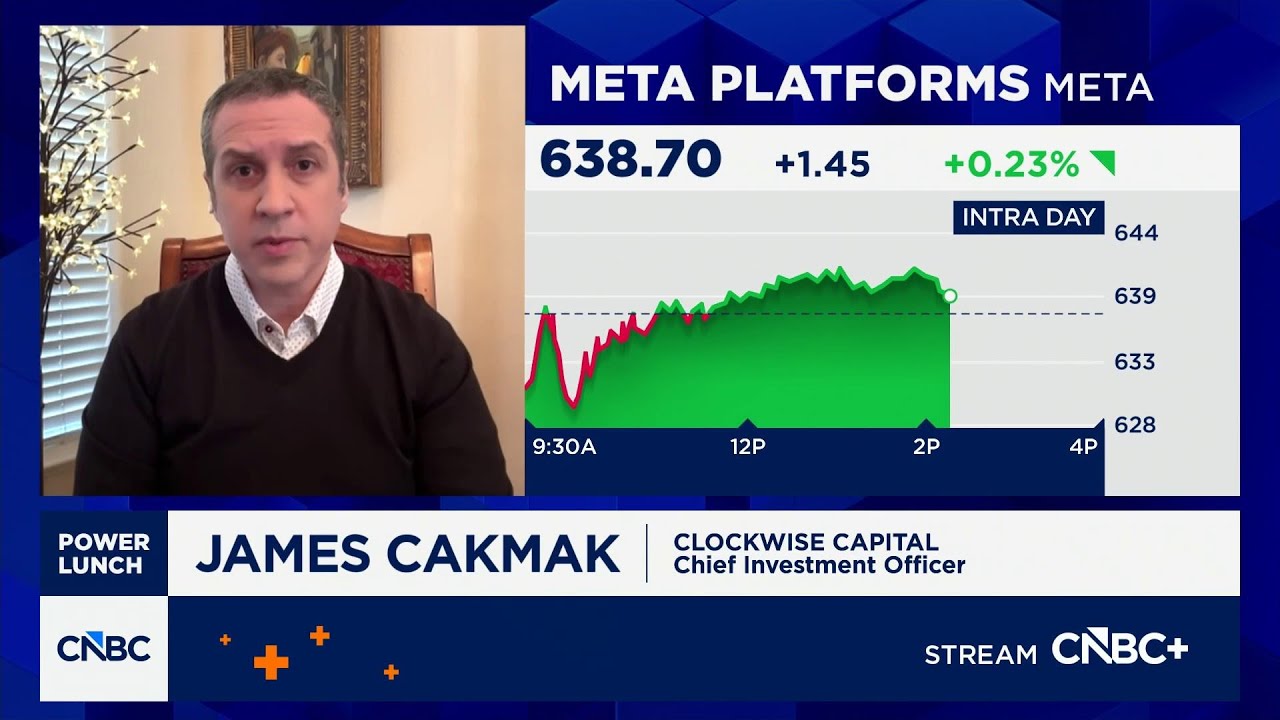

Clockwise Media

Catch our latest media appearances and market insights.

The Rules of Investing Have Changed

The strategies that worked for 40 years are breaking down. Here's what's different now.

60/40 Is Broken

Stocks and bonds now move together. The diversification that protected portfolios for decades no longer works.

Volatility Is Higher

Markets swing more violently than before. Static portfolios experience larger drawdowns during crises.

Cycles Are Accelerating

Technology, monetary policy, and geopolitics create faster rotations. Annual rebalancing isn't enough.

Adaptive Investing in 3 Steps

We combine AI-powered analysis with fiduciary advisors to help you navigate today's markets.

Score Your Portfolio

Kronos analyzes your holdings across 6 market cycles in 60 seconds.

See Opportunities

Compare to cycle-optimized strategies and identify gaps.

Talk to an Advisor

A fiduciary helps you implement changes that fit your goals.

See How Your Portfolio Scores

Get an instant analysis across 6 market cycles. Identify exposures and opportunities in under a minute.

Solutions

Portfolio Options

Explore our range of investment products designed to help you navigate economic and technology cycles with confidence.

Clockwise Single ETF Portfolio

Investment Minimum: <$50 — Clockwise ETF NYSE: TIME is an active managed hedged growth fund. TIME rebalances daily to adapt to dynamic technology and economic cycles.

Clockwise Diversified Growth Portfolios

Investment Minimum: $50k+ — Clockwise Adaptive Portfolios leverage AI & human experts to broadly diversify ETF portfolios for maximum risk-adjusted growth that rebalance on a monthly basis to align with investors' unique risk preferences and goal time horizons.

Clockwise Diversified Income Portfolios

Investment Minimum: $50k+ — Clockwise Adaptive Portfolios leverage AI & human experts to broadly diversify ETF portfolios for maximum risk-adjusted income that rebalance on a monthly basis to align with investors' unique risk preferences and goal time horizons.

Guidance

Choose Your Level of Support

From self-directed to full-service — get the guidance that fits your situation.

Kronos AI

Educational insights and portfolio analysis powered by AI

- Portfolio scoring & analysis

- Market cycle education

- Strategy recommendations

Portfolio Builder

Human advisor support for straightforward financial situations.

- Everything in Self-Guided

- Dedicated fiduciary advisor

- Cash flow planning

- Quarterly reviews

Wealth Optimizer

Comprehensive planning for complex financial situations.

- Everything in Coached

- Tax optimization strategies

- Estate & legacy planning

- Risk & insurance review

Results

What Our Clients Say

"The portfolio analysis opened my eyes to risks I didn't know I had. After working with their advisor team, I much more confident about my retirement timeline."

Brandon W.

Business Owner, 52

"I was skeptical about AI-driven investing, but the cycle analysis convinced me. My portfolio weathered the recent volatility much better than my old 60/40 allocation."

Michael L.

Tech Executive, 47

"Finally, advisors who actually explain why they're making changes. The combination of AI insights and human expertise is exactly what I was looking for."

Sarah K.

Physician, 55

Our Mission

Investing Evolved

Markets move faster than ever. Technology cycles, monetary policy, and geopolitics create complexity that static portfolios can't handle. We built Clockwise to give everyday investors access to the adaptive strategies institutions have used for decades — combined with fiduciary advisors who actually explain what's happening and why.